Complete Guide to Opening a Bank Account in Japan for Foreigners: All You Need to Know About Requirements, Procedures, and Key Tips

Aug 7, 2025

Congratulations on your new life in Japan! Whether you're here to study, work, or invest in real estate, people come to Japan for various reasons. But no matter your goal, opening a bank account is a crucial step for starting your life smoothly in Japan.

From receiving your salary, paying rent and utility bills, to signing up for a mobile phone plan—having a bank account is central to daily life here. But for many foreigners, setting up a Japanese bank account can be the very first major challenge, thanks to language barriers and unique local rules.

This article is a complete guide for foreigners opening a Japanese bank account for the first time. You'll find clear explanations of the essential requirements, detailed step-by-step instructions, and tailored strategies for different situations, so you can proceed with confidence.

Most Important: The Two Fundamental Requirements for Opening a Bank Account

No matter which bank you choose, there are two major requirements you must meet to open an account in Japan. These are absolute ground rules with no room for negotiation, so make sure you understand them before getting started.

Requirement 1: Proof of Residency – Are You Officially a Resident?

Japanese banking law strictly distinguishes between "residents" and "non-residents"—and this is the single most important point determining whether you can open a bank account.

-

In Principle: You Need to Stay for Over 6 Months

Generally, if you have been in Japan for less than six months, you are classified as a “non-resident.” In this case, you cannot open a standard (futsuu) checking account for things like salary deposits or paying utility bills. This rule is based on laws designed to prevent money laundering and other financial crimes. -

Beware the "Non-Resident Yen Account" Trap

It’s sometimes possible to open a special "non-resident yen account" if your stay is under six months. However, these have significant restrictions: you cannot receive overseas remittances, set up bill payments, or even get a cash card, so they are impractical for daily life. -

Exceptions for Shorter Stays

- Japan Post Bank (Yucho): If your period of stay is three months or longer, this is one of the most foreigner-friendly options and you are likely to be able to open a standard account.

- Banks like Mizuho: If you can prove you have secure employment with a Japanese company (for example, with your staff ID or employment contract), some banks may be flexible about the 6-month rule.

Requirement 2: Proof of Your Physical Address in Japan (Juminhyo Registration)

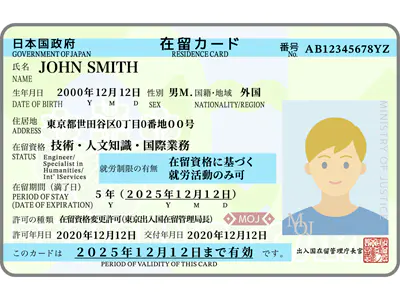

If you plan to stay in Japan for more than three months, you will be issued a Residence Card (“Zairyu Card”). After moving in, you must register at your local city hall. This registration is required to obtain a certificate of residence (Juminhyo), which proves you have a fixed address in Japan and is essential to open a bank account.

Tip: It’s important to do things in the right order in Japan: 1) Secure housing → 2) Register your address at city hall and receive your Residence Card and Juminhyo → 3) Open your bank account.

Checklist: What You Need to Open a Bank Account

Be sure to prepare the following items before heading to the bank. Any missing documents may cause delays and additional trips.

| Required Item | Details & Important Notes |

|---|---|

| 1. Official ID | Your Residence Card is mandatory. It must show your name, address, date of birth, and visa/permit status, with at least 3 months validity remaining. It's wise to also bring your passport. Students may need to show their student ID; employees may be asked for their staff ID. |

| 2. Proof of Address | In most cases, the address on your Residence Card is accepted. However, you may also need a copy of your “Juminhyo” (residence certificate issued by city hall), or an original utility bill (for electricity, gas, water, or NHK). Note: mobile phone bills are usually not accepted. |

| 3. Personal Seal (Hanko/Inkan) | Japan still uses personal stamps for signatures on contracts. You can make a seal in katakana, alphabet, or with kanji for your name. “Shachihata” pre-inked stamps are NOT accepted. Some banks now accept signatures only, but you’ll likely need a seal for other contracts, so having one is convenient. |

| 4. Japanese Phone Number | A local cell phone number is required as your contact detail. However, to get a phone contract you may need a bank account—chicken-and-egg! One workaround is temporarily using your employer’s number and updating it to your own later. |

| 5. Some Cash | When opening an account, you may be asked to make an initial deposit (typically around 1,000 yen), so don’t forget to bring some cash. |

Recommended Banks & Step-by-Step Process (Depending on Your Situation)

Once you have your documents ready, it’s time to choose the bank that fits you best and apply. Here’s how to decide and how the process generally works.

Step 1: Choose the Right Bank for You

Case 1: Just Arrived in Japan (Less than 6 months Resident)

Your choices are limited at this stage, but don’t worry:

- Japan Post Bank (Yucho): This is the most recommended choice if you have at least 3 months’ residency. You’ll find Post Office branches and ATMs nationwide, making it very convenient. Start here to establish your basic finances.

Case 2: Over 6 Months Resident

Once you’re recognized as a “resident,” you can apply at virtually any bank.

- Mega Banks (Mitsubishi UFJ, SMBC, Mizuho): These are large, reliable banks with many branches, but the rules are strict and you’ll probably have to apply in person. (Mitsubishi UFJ does not accept online applications from foreigners.)

- Online Banks (Rakuten Bank, Sony Bank, SBI Shinsei, Seven Bank): These offer strong English support online, easy procedures (often no seal required), and lower fees. They’re also great if you regularly send money internationally.

- Foreigner-Focused Services (SMBC Trust PRESTIA, etc.): These offer premium English support, but usually charge a maintenance fee and are aimed at high-net-worth clients.

Step 2: Application Method – At the Counter or Online?

Applying at a Bank Branch:

- Benefits: You can ask questions in person and have your documents checked on the spot.

- Note: Open hours are usually 9am–3pm weekdays. If you’re not confident in Japanese, bring a Japanese-speaking friend or colleague for support. Banks near your home or work are preferred.

Applying Online or via App:

- Benefits: You can apply at any time, and you don’t need to physically visit the bank.

- Note: Some apps (like Japan Post Bank’s) offer English, but most are Japanese only. You’ll need to upload documents and be fairly comfortable with smartphones.

Step 3: Application & Review

Fill out the application form and submit all required documents. Be clear about how you intend to use the account (salary payments, living expenses, etc.). The bank will review your information, and the account will be opened if there are no issues.

Step 4: Receiving Your Passbook and Cash Card

If you apply at a branch, you usually get your passbook on the spot. For security, your cash card is often mailed to you 1–2 weeks later, by registered mail.

Special Cases: For Real Estate Investors and Entrepreneurs

If you’re opening an account for real estate investment or business purposes, the requirements are even tougher than for personal accounts.

For Real Estate Investors

Many banks are cautious about lending to foreigners wishing to buy Japanese property.

Challenge:

Most banks require you to have permanent residency or a solid Japanese tax record. If you are a non-resident, it is extremely difficult to get a property loan.

Solutions:

- Look for banks offering loans to non-residents: For example, Tokyo Star Bank may have special products open to wealthy clients from places like Taiwan or Hong Kong, but these are highly limited.

- Try non-bank lenders: Some, like Orix Bank, will provide general-purpose loans if you already own property in Japan, but rates are often higher.

- Establish a Japanese company: This is the most common workaround; by setting up a company in Japan, you can apply for property buying or loans in the corporate name, rather than as an individual non-resident.

For Entrepreneurs (Opening a Corporate Account)

A corporate bank account is essential for starting a business in Japan, but the screening is much stricter than for personal accounts.

Challenge:

Banks are very cautious about money laundering and terrorism financing, especially for new companies or those run by foreign nationals.

Success Tips:

- Local representative director: Your company's legal rep must have valid residency status and a Japanese address.

- Physical office: Virtual or shared offices are often regarded with suspicion—having a dedicated, physical office boosts your credibility.

- Clear business plan: Prepare documents demonstrating what the business does and how it generates revenue, as well as a company website and other proof of legitimacy.

- Consult a professional: Company formation and opening a corporate bank account can be complex; working with a judicial scrivener or consultant is often the best path.

Important Notes After Opening Your Account

- You must update your info if it changes! If you move, renew your residency, or otherwise change any of the details you've provided, you are required to notify your bank as soon as possible. Failing to do so can result in sudden freezes or restrictions on your account.

- If You Leave Japan (Returning Home) When leaving Japan for good, be sure to formally close your account at a branch. Simply leaving a zero balance may result in account maintenance fees or risk of misuse.

Summary

For foreigners, opening a bank account in Japan is a process where careful preparation is the key to success.

- New arrivals: Start with Japan Post Bank if you have at least a 3-month visa—it’s your easiest way to set up basic banking.

- Over 6 months: Once your life is established, explore mega banks or online banks, and consider opening additional accounts for added convenience.

- Real estate investors and entrepreneurs: Opening loans or corporate accounts involves specialized knowledge and should not be attempted alone—always consult with property agents or legal professionals.

We hope this guide helps make your start (or business) in Japan as smooth and certain as possible. Japan-Property supports your journey!